Last Updated on May 20, 2025

Climate change is no longer just a scientific concern—it’s also a financial opportunity. Over the past few years, the climate tech sector has exploded, attracting billions of dollars from venture capitalists, corporations, and even regular investors looking to align their portfolios with a greener future.

From battery technology to carbon capture, the money is flowing into innovative solutions that promise to decarbonize the planet while delivering returns. But where exactly is this money going? And what does it mean for the fight against climate change? Let’s break it down.

1. Battery Technology: Powering the Future

If there’s one area that’s stealing the spotlight, it’s battery technology. As the world shifts away from fossil fuels, batteries are the backbone of the clean energy transition. They store renewable energy from solar and wind, power electric vehicles (EVs), and even help stabilize grids. No wonder investors are pouring cash into this space.

In Europe, the European Union has earmarked a hefty €1.8 billion to bolster the battery raw materials supply chain, aiming to strengthen the continent’s battery manufacturing capabilities.

Meanwhile, Chinese battery giant CATL is expanding its global footprint, and just floated a very successful IPO on the Hong Kong Stock exchange. The company has announced plans for a second European battery plant in Hungary, aiming to supply major automakers like Mercedes-Benz and BMW. This move is part of CATL’s strategy to meet the growing demand for EV batteries in Europe.

However, the road isn’t entirely smooth. Swedish battery maker Northvolt has faced financial hurdles, filing for Chapter 11 bankruptcy protection in the U.S. last November. In response, Scania, a Swedish truck manufacturer, and Northvolt shareholder, has diversified its supply chain by securing alternative battery cell suppliers to ensure the continued rollout of its electric fleet.

Why the hype?

Policy shifts like the U.S. Inflation Reduction Act and the EU’s Green Deal are funneling billions into clean energy infrastructure, creating a massive battery market. Plus, battery tech and materials science advancements are driving down costs and improving performance.

For investors, this is a long-term play: the global battery market is expected to grow from $100 billion in 2022 to over $400 billion by 2030.

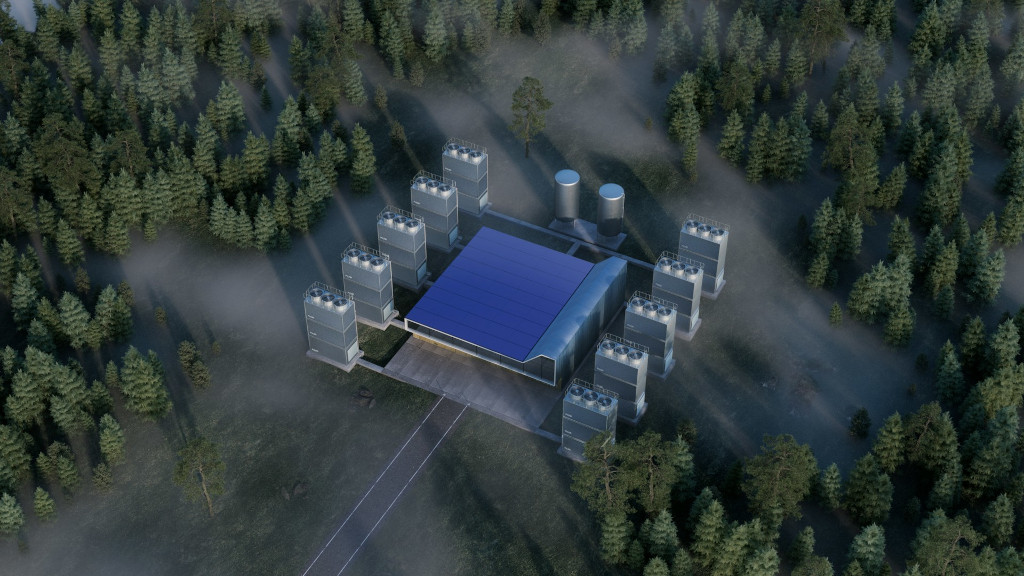

2. Carbon Capture and Removal: Sucking CO2 Out of the Air

Carbon capture and removal technologies are having a moment. These solutions aim to pull CO2 directly from the atmosphere, or capture it at the source (like power plants), and store it underground or use it to make products. It’s a critical piece of the decarbonization puzzle, especially for industries that are hard to decarbonize, like cement and steel.

Climeworks, a Swiss company, is a leader in direct air capture (DAC). They’ve raised over $800 million to build massive facilities that suck CO2 out of the air and store it permanently. Meanwhile, CarbonCure is making waves by injecting captured CO2 into concrete, making it stronger and greener.

Investors are betting big because governments are stepping up.

The U.S. recently increased tax credits for carbon capture under the Inflation Reduction Act, making it more financially viable. The market for carbon removal could hit $1 trillion by 2050, according to BloombergNEF.

This is still a nascent space for regular investors, but it’s one to watch as it matures.

3. Renewable Energy: Solar, Wind, and Beyond

Renewable energy isn’t new, but it’s still a hotbed of innovation and investment. Solar and wind power are now cheaper than fossil fuels in most parts of the world, and the race is on to make them even more efficient and scalable.

NextEra Energy, one of the largest renewable energy companies in the U.S., has seen its stock soar as it builds out massive solar and wind farms. On the startup side, Heliogen is using AI to optimize solar power generation, while Ørsted is leading the charge in offshore wind.

What’s driving the investment?

Policy support, falling costs, and the sheer scale of the opportunity. The International Energy Agency (IEA) estimates that global renewable energy capacity needs to triple by 2030 to meet climate goals. That’s a lot of solar panels and wind turbines—and a lot of money to be made.

4. Green Hydrogen: The Fuel of the Future?

Hydrogen has been touted as the “fuel of the future” for decades, but it’s finally having its moment—especially green hydrogen, which is produced using renewable energy. It’s a versatile fuel that can be used in industries like shipping, aviation, and heavy manufacturing.

Plug Power, a green hydrogen company has seen its stock surge as it secures deals with companies like Amazon and Walmart. Meanwhile, ITM Power in the UK is building electrolyzers to produce green hydrogen at scale.

Why the excitement? Green hydrogen is seen as a key solution for decarbonizing industries that can’t easily switch to electricity. The European Union alone plans to invest $500 billion in green hydrogen by 2050. For investors, this is a high-risk, high-reward play, but one with enormous potential.

5. Electric Vehicles (EVs) and Charging Infrastructure

The EV revolution is in full swing, and investors are all in. From car manufacturers to charging networks, this sector is booming. Tesla may be the poster child, but traditional automakers like Ford and GM are also going electric, with plans to phase out internal combustion engines entirely.

Startups are getting in on the action too.

Rivian, an electric truck maker, raised over $12 billion in its IPO, while ChargePoint, a charging network provider, went public via SPAC. The charging infrastructure space is particularly exciting, as it’s a bottleneck for EV adoption. Companies like EVgo and Blink Charging are racing to build out networks across the U.S. and Europe.

For investors, the EV market is a no-brainer. Governments are banning gas-powered cars, subsidies are making EVs more affordable, and consumers are increasingly going green. The global EV market is projected to grow from $280 billion in 2021 to $1.3 trillion by 2028.

6. Sustainable Agriculture and Food Tech

The food system is a major contributor to climate change, but it’s also a huge opportunity for innovation. From lab-grown meat to vertical farming, investors are betting on technologies that can sustainably produce more food.

Beyond Meat and Impossible Foods have become household names, but the space is much broader. Indigo Ag is using microbes to improve crop yields and reduce the need for fertilizers.

The market for sustainable food tech is massive. According to Barclays, the alternative protein market alone could be worth $140 billion by 2029. With consumers increasingly demanding eco-friendly options, this sector is poised for growth.

How Regular Investors Can Get In on the Action

So, you’re not a venture capitalist with millions to throw around—how can you invest in the climate tech boom? Luckily, there are plenty of options for regular investors, from ETFs to mutual funds.

1. ETFs: Exchange-traded funds are a great way to diversify your investments. Some popular climate-focused ETFs include:

- iShares Global Clean Energy ETF (ICLN): Tracks clean energy companies worldwide.

- Invesco Solar ETF (TAN): Focuses on solar energy companies.

- SPDR S&P Kensho Clean Power ETF (CNRG): Invests in companies driving the clean energy transition.

2. Mutual Funds: If you prefer actively managed funds, check out options like the Pax Global Environmental Markets Fund or the Calvert Global Energy Solutions Fund.

3. Green Bonds: These are fixed-income investments that fund environmentally friendly projects. They’re a lower-risk way to support the climate tech sector.

4. Crowdfunding Platforms: Websites like Wefunder and StartEngine allow you to invest in early-stage climate tech startups.

What It All Means for Decarbonization

The surge in climate tech investment isn’t just about making money—it’s about protecting the planet. These technologies are critical for reducing greenhouse gas emissions and achieving net-zero goals. But there’s still a long way to go. Many of these solutions are in their early stages and need continued support to scale.

For investors, this is a chance to be part of something bigger. By putting your money into climate tech, you’re not just betting on the future—you’re helping to shape it.The climate tech boom is here, and it’s only getting bigger. From batteries to green hydrogen, the opportunities are vast—and so is the potential impact.

***

Disclaimer:

The financial information provided herein is for informational purposes only and does not constitute financial, investment, or other professional advice. It does not consider your personal objectives, financial situation, or needs. All investments carry inherent risks, including potential loss of principal. Past performance is not indicative of future results. Before making any investment decisions, you should conduct your own research and consult with a qualified financial advisor. Reliance on any information provided is solely at your own risk.